Back in 2013, FinTech was a sexy catch-all-phrase that encompassed any application or platform that had to do with calculating numbers and financial information; it covered such a broad-spectrum of ventures and ideas.

Over time, the “FinTech venture” became more refined, focused on solving real problems surrounding consumer financial products and services and dealing with business-to-business legacy processes and systems. For example, lending, borrowing, transferring money, mortgages and even banking.

Since its rapid evolution from 2013, it fizzled a little bit because, well, finance (and everything associated with it) is not really THAT exciting…but it did grow. To get back on the radar, all FinTech needed was to dress up a bit and become noticeable again in the form of artificial intelligence.

Why Not Cryptocurrency and Blockchain instead of FinTech and Artificial Intelligence?

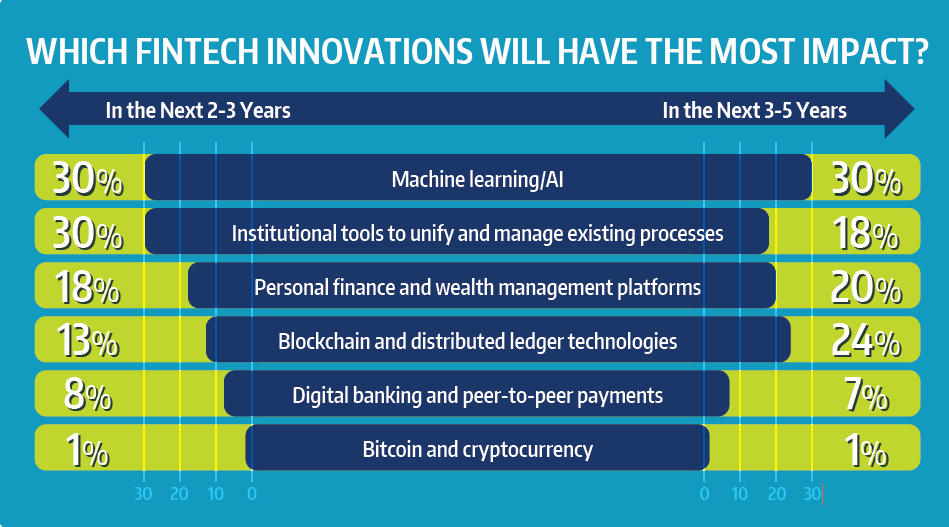

Most people would think that cryptocurrency and blockchain would be what brings FinTech back to the forefront but what I am finding is that Artificial Intelligence is what is making FinTech more attractive again; I am not the only one. According to a study by Meidant Inc, machine learning and artificial intelligence were ranked as the top innovation that will have the most impact on organizations and individuals.

A Personalized Experience

By using all the data, analytics and machine learning best-practices, financial institutions can use artificial intelligence to collect insights on human behaviour. With all this information, they will be able to offer customized services and products and make our engagement with financial professionals much more efficient.

Engaging and meaningful conversations about finance

Artificial intelligence in FinTech will also provide more meaningful and engaging conversations. Forget about all those qualifying-questions that are asked of consumers endlessly; just “complete the online form”, we are often told (the form takes forever to complete!). With AI, the conversation between financial professional and consumer or business is much more intuitive. This makes is easier for the consumer but it also makes it much more efficient for financial institutions.

So there are many benefits to FinTech and artificial intelligence but the bottom-line benefit is clear: artificial intelligence in FinTech creates a new channel for brands to engage with their audiences and for businesses to simplify processes, systems and tasks.

At PayUp Jack, incorporating artificial intelligence has always been a priority from the get-go. This is why we developed our image validation feature instead of the traditional alphanumeric password approach to confirm a transaction between friends. We want to bring brands and promotions to our customers depending on the social activity that is being organized – for us, it has ALWAYS been about creating a personalized and seamless experience.